The 5 Steps of ASC 606

Introduction

As a business, you may be aware of the new ASC 606 accounting standard that was released in late 2014. The goal of this standard is to create a more accurate and consistent representation of revenue for businesses across industries. However, the transition to ASC 606 can be a complicated and time consuming one. In this post, we will explain some key concepts to help you with a smooth transition and continued compliance within the ASC 606 guidelines. Let’s get started!

What is ASC 606?

The new Accounting Standard ASC 606 was announced in May 2014, and after comments, effective dates were set: businesses were to officially move to the new standards for annual reporting periods beginning after December 15, 2017 for public companies and annual reporting periods after December 15, 2018 for private companies. This standard essentially covers revenue from contracts with customers and identifies performance and licensing obligations. It tells companies how to recognize revenue earned from business operations.

What is an ASC 606 memo?

This type of memo is most commonly in the form of a spreadsheet to provide accurate reporting and facilitate approval processes. The memo format consolidates financial metrics into a central location for easy access and analysis by different levels of management.

Why is revenue recognition important?

Revenue recognition is important because it helps give a clear picture of how much money a company is really making and when they’re making it. This clarity is crucial for investors, creditors, and other stakeholders who want to understand the financial health of the company. Plus, following the guidelines ensures that companies report their revenue consistently and accurately, which builds trust and transparency in the financial markets. So, revenue recognition might sound technical, but it’s a big deal for understanding a company’s financial story.

How do you recognize revenue under ASC 606?

All businesses and organizations that enter into contracts or sales agreements with customers starting in the fiscal year after December 15, 2017 are affected by ASC 606. This includes public, private, and not-for-profit entities. The standard 5 steps apply to contracts entered with customers to transfer goods or services or for the transfer of nonfinancial assets, unless they are bound within the confines of other standards.

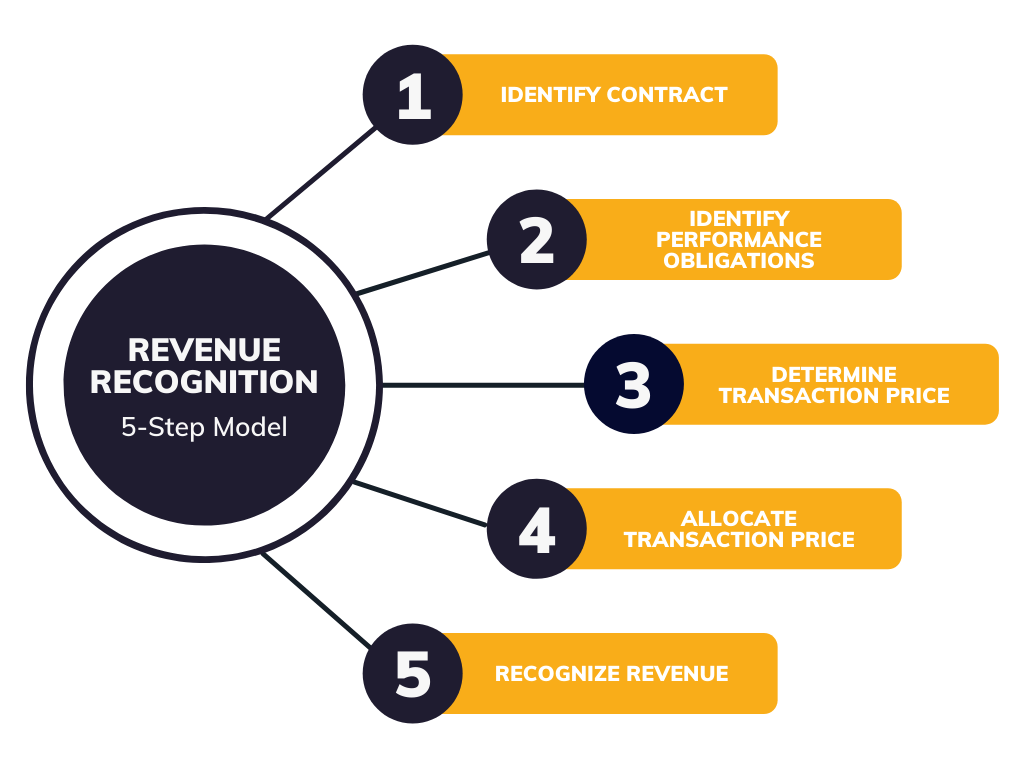

What are the 5 steps of ASC 606?

The ASC Revenue Recognition 5 step process is an industry standard used to help determine in what cases and how much revenue should be recognized.

Step 1: Identify the Contract

For the purposes of ASC 606, a contract is an agreement that involves two or more parties. This agreement must:

-

Have the approval of all parties

-

Confirm that all parties are committed to fulfilling their obligations

-

Identify the party’s rights regarding the transfer of agreed upon goods or services

-

Identify payment terms

-

Indicate that the contract/deal is commercially substantive

-

Be predicated on the belief that the vendor is likely to receive payment

Step 2: Identify Performance Obligations

A performance obligation means whatever is promised in terms of transferring goods and/or services between a vendor and the consumer. This may sound simple, but ASC 606 specifically mentions distinct performance obligations, which adds complexity to this process of identification. For a good or service to be considered distinct, it must be:

1) Something the customer can benefit from on their own or by using other readily available resources

2) Identifiable on its own, and therefore held distinct from other promises in the same contract

There are many details involved in determining whether a performance obligation is truly distinct. Unique to each type of contract, promised goods or services may include the following:

- Sale of goods produced by an entity

- Resale of goods purchased by an entity

- Resale of rights to goods or services purchased by an entity

- Performing a contractually agreed-upon task for a customer

- Providing a service of standing by ready to provide goods or services or of making goods or services available for a customer to use as and when the customer decides

- Providing a service of arranging for another party to transfer goods or services to a customer

- Granting rights to goods or services to be provided in the future that a customer can resell or provide to its customer

- Constructing, manufacturing, or developing an asset on behalf of a customer

- Granting licenses

- Granting options to purchase additional goods or services

An unsatisfied performance obligation is a commitment in a contract that has not yet been completed or otherwise satisfied. Unsatisfied performance obligations represent the future revenue an entity expects to receive from its customer under the terms of a contract, but which it has not yet been paid.

Step 3: Determine Transaction Price

A contract typically includes the agreed-upon price the vendor expects to get in return for the transfer of the promised good or service. Contract price does not include third-party variables such as sales tax, and it doesn’t consider potential future options. Determining the price is often the easiest of the five steps. This is especially true when the transfer involves a fixed cost that is payable when the good/service is delivered. For example, if you sell something and the customer hands over cash, that is an immediate and direct transaction. When financing, bartering, bonuses, coupons and rebates, and other factors come into play, determining price can become more complicated.

Step 4: Allocate Transaction Price

Determining how much the transaction actually represents economically may be a matter of judgment and you may have to make some educated estimates. For the most part, you’re basing allocation on the relative standalone price of each good or service. The standard does mention 3 methods (the adjusted market assessment, expected cost plus margin, and residual approach) for estimating uncertain standalone selling prices.

In Quickbooks, record deferred revenue under the ‘other current liability’ option. Set up products and services, and edit income account to deferred revenue. As you deliver, move items from deferred revenue and credit them as income under the appropriate account.

Step 5: Recognize Revenue

Revenue recognition is a generally accepted accounting principle that identifies the specific conditions in which revenue is recognized and determines how to account for it. Revenue is to be recognized when the performance obligation has been fulfilled either at a point in time or overtime, or in other words, when an income-generating event occurs and results in an identifiable amount.

Can you recognize revenue before invoicing?

The revenue recognition principle of ASC 606 requires that revenue is recognized when the delivery of promised goods or services matches the amount expected by the company in exchange for the goods or services.

Basically, revenue can only be recognized when realized and earned, not necessarily when products are delivered, services are rendered or payment is received. Complications can and do arise as to when revenue can be recognized. For example:

-

Point-in-time revenue recognition: Considered the most basic revenue recognition process, it allows companies to recognize revenue as soon as an invoice is sent or when a service is rendered.

-

Scheduled revenue recognition: Also referred to as overtime revenue recognition, it allows companies to recognize revenue based on a set interval of time. Timing can be daily, weekly, monthly, or even customized. Customized revenue recognition enables you to set timings based on contracts, customers, or groups of customers.

What is variable consideration under ASC 606?

ASC 606 requires that a variable amount promised within a contract be included as a consideration. Therefore, an entity should estimate the amount of the consideration to which it will be entitled in exchange for transferring the promised goods or services to a customer.

Is ASC 606 the same as IFRS 15?

A completed contract under ASC 606 is defined as a contract in which all, or substantially all, the revenue has been recognized. Under IFRS 15, a completed contract is one in which the entity has transferred all goods or services.

Further, ASC 606 and IFRS 15 are accounting standards that guide how companies should recognize revenue from contracts with customers. While they share similarities, they have some differences. ASC 606, part of the U.S. Generally Accepted Accounting Principles (GAAP), focuses on revenue recognition when control of goods or services is transferred. It offers detailed guidance on the principal-agent distinction and licensing arrangements. In contrast, IFRS 15, under the International Financial Reporting Standards (IFRS), emphasizes control transfer too but is somewhat more principle-based, leaving room for judgment on certain matters. It also provides some guidance on licensing but with less detail. Both standards mandate thorough disclosures about revenue from customer contracts. Companies should follow the relevant standard based on their reporting framework (ASC 606 for U.S. GAAP and IFRS 15 for IFRS) and adhere to their specific guidelines and disclosure requirements for accurate revenue recognition.

How does ASC 606 affect the percentage of completion?

ASC 606 requires that companies estimate the selling price for each distinct good or service when they sell to a customer. It further requires that said companies must determine this amount objectively, the transaction price is the best evidence of selling price, and it should be based on market conditions at an earlier date than when revenue is recognized.

What are contract assets and contract liabilities?

A contract asset is recognized when an entity has satisfied a performance obligation but cannot recognize a receivable until other obligations are satisfied. They represent the right to receive payment for goods or services that a company has transferred to a customer but hasn’t yet billed. Essentially, it’s money that the company has earned but hasn’t been paid yet.

A contract liability is recognized when a customer prepays consideration or owes prepayment to an entity according to the terms of a contract. They arise when a company receives payment from a customer before it has fulfilled its obligations under the contract. These are essentially advance payments or deposits from customers for goods or services to be delivered in the future.

What is the revenue recognition principle?

The revenue recognition principle, according to ASC 606, is basically a guideline that tells companies when they should record revenue on their books. It’s like a rulebook that helps keep things fair and square in the world of finance.

In simple terms, it says that revenue should be recognized when goods or services are transferred to customers in exchange for payment. So, when a company completes a sale or fulfills a service and the customer pays up, that’s when the revenue gets recorded.

Following this principle ensures that companies report their revenue in a way that reflects when they’ve actually earned it, which makes financial statements more accurate and reliable. So, it’s a key rule to follow for keeping everyone in the financial world on the same page!

Conclusion

In conclusion, navigating the transition to ASC 606 is essential for businesses striving to provide a precise and uniform depiction of their revenue. While it may seem complex and time-consuming, understanding the fundamental concepts is the first step toward a seamless adaptation and ongoing compliance with ASC 606 guidelines.

With our insights in this post, we aim to simplify the process and equip your business with the knowledge needed to ensure a smooth transition. Let’s embark on this journey towards a more accurate financial representation together! Reach out to us today and we can begin the process together.

We hope this information is helpful and that you have a better understanding of ASC 606 and its five steps. Our team at Finvisor specializes in accounting services for small-to-medium-sized companies and can provide guidance on compliance with these regulations. Let us know if there are any questions about these changes as well as anything else related to finance management!

*This blog does not constitute solicitation or provision of legal advice and does not establish an attorney-client relationship. This blog should not be used as a substitute for obtaining legal advice from an attorney licensed or authorized to practice in your jurisdiction.*

- Last Modified

- February 14, 2024

FOR ANY QUESTIONS

CONTACT US

- MAILING ADDRESS

Finvisor HQ

48 2nd St, 4th Floor

San Francisco, CA 94105

- PHONE NUMBER

- EMAIL ADDRESS

"*" indicates required fields