You’re likely familiar with the process of writing off business expenses every month. But when it comes to major purchases like equipment or property, it’s completely different.

Writing off the full value could drastically affect your reported net income for the year, misrepresent asset value and potentially make your company appear unprofitable to investors and shareholders.

To accurately represent the value and cost of a fixed asset, you’ll instead need to account for it over the course of multiple years through depreciation.

Let’s learn more about what depreciation is, which assets can be depreciated and how you can calculate depreciation accurately.

What Is Depreciation?

In accounting, depreciation refers to the cost of a tangible asset over the span of its useful life. It is treated as an expense on your income statement in order to reflect the asset’s cost over time.

There are several terms you’ll need to be familiar with to understand depreciation:

- Tangible asset: The physical assets your company owns, which are distinct from intangible assets like patents and copyrights. Depreciation is only used for long-term fixed assets that will last for over a year.

- Useful life: The amount of time an asset is estimated to be productive and used by your business.

- Cost: Includes all expenses incurred to obtain the asset and get it set up to be used, including initial purchase price, shipping fees and installation labor costs.

What Assets Can Be Depreciated?

Only some assets can be depreciated. The IRS defines depreciable assets under these guidelines:

- You or your business must own the asset or be making capital improvements to it.

- You must be using the asset for business or income-producing purposes. If the asset is also used in part for your own personal, non-business use, you may only depreciate the portion used for income-producing activities.

- The asset must be held long-term; that is, it must have a useful life of one year or more.

Common assets that fall under these guidelines include:

- Office buildings

- Commercial property

- Residential property

- Vehicles

- Machinery

- Equipment

- Computers, phones and other technology

What Assets Cannot Be Depreciated?

Some tangible assets are not able to be depreciated. Most notably, you cannot depreciate assets that don’t naturally lose their value over time, including:

- Land

- Stock and bond investments

- Collectible items like art

You are also unable to depreciate assets that you are not currently using as a source of income. For instance, if you own a commercial building but are not actively renting it out or using it for income, you can’t depreciate it.

The same rule applies to personal property that you are not using for business-related purposes, such as your personal vehicle.

Intangible Assets

While they are just as valuable to your company as tangible assets, intangible assets are not depreciated. They are instead amortized.

Amortization is recorded in your financial statements in order to write off an intangible asset over the span of its useful life, which spreads its cost out over time.

With the straight-line method, the same amount of amortization expense is recorded each year, while there are multiple methods available for depreciating tangible assets.

Common intangible assets that can be amortized (but not depreciated) include:

- Trademarks

- Copyrights

- Patents

- Franchise agreements

- Software

- Loans

How Can You Calculate Depreciation?

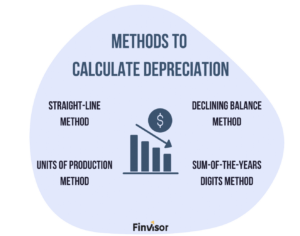

There are several methods that your company or accounting partner can use to determine the amount your assets will depreciate every year.

Straight-Line Method

Due to its simplicity, the straight-line method is the most common and straightforward way of determining depreciation. This method equally depreciates an asset over the span of its useful life, meaning the expense value will be the same every year.

Declining Balance Method

Many assets are much more valuable and productive in their first few years of use. Consider a computer, for instance: its quality and resale value is much higher during its first few years of life.

The declining balance and double declining balance methods calculate a larger depreciation expense in an asset’s first few years of its useful life, and less depreciation later on.

These methods are best for assets that lose their value quickly, like technology and new vehicles.

Sum-of-the-Years Digits Method

This is another accelerated depreciation method, which multiplies an asset’s depreciable value by a fraction. This fraction is found by adding up the sum of the years of an asset’s useful life.

Next, each year’s digit is divided by this number to get the percentage your asset should be depreciated each year.

Similar to the declining balance method, this method reflects how many assets are worth more during their first few years of use.

Units of Production Method

The units of production method is used when depreciation is tied to the number of units produced, rather than to how long you have held an asset. Depreciation may fluctuate based on the year or month, especially for seasonal businesses.

This method is most commonly used for machinery and manufacturing, where the number of uses is highly tied to the value and level of wear-and-tear of an asset.

Why Understanding Depreciation Is Important

These are some of the main reasons why understanding depreciation is important.

It Reflects Your Business Performance More Precisely

Putting a huge expense like new machinery on your financial statements can make your company appear far less profitable than you are.

Spreading the cost out over an asset’s useful life gives you and potential investors a much clearer picture of your financial performance, while still remaining financially transparent.

It Gives You Tax Benefits

Just like writing off inventory costs and business meals with clients, depreciating large assets reduces your taxable income, meaning you’ll owe less when tax time comes around each year.

It Helps You Accurately Manage Your Assets

Businesses need to account for when tangible assets need to be replaced. Depreciation tracks declining value over time, making it easier to schedule timely, budget-conscious replacements.

Final Thoughts

Whether you’re a small startup working from a home office or a medium-sized company with multiple retail locations, most businesses have large assets to account for in their balance sheets.

Understanding depreciation helps ensure your finances are accurately represented every year.

Need help figuring out how to depreciate your assets? Our team at Finvisor is here to help with all your accounting and bookkeeping needs.

Get in touch with us today for a free introductory call to see how we can help you.

Let's chat

Get on our calendar for a free introductory call.Request a Quote

We'll get back to you within a business day, usually sooner. Or you can schedule an introductory call and get on our calendar."*" indicates required fields