While it’s exciting and rewarding to see your business grow, there comes a point where your current strategy stops moving you toward your goals. That’s when you need a new financial strategy to get to that next level.

For many businesses, this means securing extra funding. The question is, where should it come from?

The good news is that in 2025, businesses have a wide range of funding options, from traditional small business loans to newer funding sources like crowdfunding.

In this article, we’ll explore all the possibilities to help you determine which type of funding is right for your future growth.

Why Funding Growth Is Different From Starting Up

Scaling a business is not the same as starting one up.

In the beginning, startup capital is generally allocated to research and development, as well as establishing a market presence. Funds are also needed to launch products and reach customers.

Lenders see this as higher risk since the market’s reaction to your product or service is uncertain.

In contrast, when your business is more established, you have hard evidence that your marketing has worked, and your products have an audience.

But to grow bigger, you need extra funding to scale your operations to a point where you can create more products within a faster timescale.

So what does this look like in reality?

Typically, growth funding is used for one or more of the following:

- Hiring additional team members

- Increasing inventory capacity

- Purchasing new or higher-grade equipment

- Investing in better or more expansive marketing strategies

- Expanding into new markets or geographical locations

- Upgrading existing tech stack and infrastructure

However, scaling isn’t always smooth sailing. There are a few growing pains that must be considered, no matter what you require funding for.

First, there is cash flow strain. This is when operational costs outpace the immediate revenue, reducing available cash. If not managed properly, other areas of financial management may suffer.

Second is increased risk exposure. Scaling quickly can be a high-stakes operation, especially when large investment sums are involved.

Lastly, timing can affect your growth. Quick access to capital is often essential for seizing market opportunities, yet securing funding is rarely a fast process.

Self-Funding Options

Regardless of the amount needed, business funding usually comes from two sources: self-funding or external. But first, let’s talk about self-funding.

Self-funding can be highly beneficial since it gives you more control and independence, but it also places more financial risk on you.

Some self-funding options include:

Reinvesting Profits

Reinvesting your business profits (also known as “retained earnings”) is a popular, organic method to fund growth.

It’s one of the lowest-risk strategies because you only invest what you have earned, plus you retain complete control over what you use the money for.

As you’re not borrowing money, you won’t accrue any debt or interest, and you’ll avoid the need to make regular repayments.

Reinvesting can strengthen your balance sheet, and it offers the potential to increase business valuation. Both of these factors are particularly attractive to future investors or buyers.

However, there are some downsides to be aware of.

You can only reinvest the amount of profit you generate, which limits the potential to achieve ambitious, large-scale goals.

Moreover, since profit isn’t earned all at once, your expansion process may slow down as you wait for more funds to roll in.

Personal Savings or Assets

If you have enough savings and assets, you may choose to invest them in the growth of your business.

Like reinvesting, this avoids any type of repayment, interest or debt, and you maintain full control. It’s an attractive option if traditional lenders aren’t willing to fund you.

The risk, however, falls directly on you. If growth fails, your personal assets may be lost permanently.

If this is the path you choose, set clear boundaries to limit your exposure. Only invest what you can afford to lose and ensure you keep financial reserves for emergencies.

External Funding Sources

If internal funding won’t unlock the capital you need, external funding may be the answer.

While these sources can give you access to higher amounts of capital, it’s important to remember that these funding sources also come with obligations to meet and less overall control.

Some of the most common external funding sources include:

Small Business Loans

Traditional loans are a popular choice for businesses that have a good credit score and an impeccable track record for their revenue, especially since this often leads to better repayment terms.

There are various types of loans on offer, including:

- SBA loans: Government-backed loans that come with lower interest rates. However, repayment terms are longer, which may deter some borrowers.

- Term loans: Lump-sum loans that are repaid over time with interest. Both the term and the interest depend on how high-risk you are considered to be.

- Bank loans: Loans that provide more favorable rates, especially if you have a long-standing relationship with the institution.

To get a traditional loan, you’ll typically need a credit score of at least 600. However, many lenders won’t consider you if your score is under 640 or 700. Those on the lower end may be required to put up collateral or settle for less favorable rates.

The exception is an SBA loan, where you may be considered if your credit score is less than stellar.

Lines of Credit

A business line of credit offers a flexible form of funding that allows you to get access to cash as needed, up to a pre-defined limit.

Although it’s great for managing short-term cash flow needs or covering gaps between receivables and payables, it’s not usually sufficient for full growth needs.

Credit also usually has higher interest rates than loans. It requires discipline to ensure repayments are made swiftly and in full each month to avoid snowballing fees.

Grants and Competitions

Grants are a hugely attractive source of funding because they don’t require any type of repayment.

Government agencies often offer grants and competitions, but you can also find them available through nonprofits, private corporations and even local initiatives. Take a look at local economic development programs, organizations specific to your industry, and the federal and state grant databases to see what’s available.

Given the demand for grants, competition is fierce. Success depends on standing out and managing a tough, time-consuming application process.

And while you don’t have to repay a grant, there may still be strings attached. For instance, you may be obligated to use the money for a specific purpose or adhere to reporting requirements.

Angel Investors and Venture Capital

Angel investors and venture capitalists provide funding in exchange for a share in ownership. The key difference is the source of funds: angel investors front their own money, while venture capital comes from a pool of investors.

The payoff is that the invested sum can be significant, and you often gain access to industry expertise and networking opportunities. But in return, you must be ready to give up some control and meet high expectations for growth.

It’s a big thing to consider, so ask yourself these questions:

- Are you ready to share control?

- Do you want strategic input or just funding?

- Can you deliver a high return on investment within 5 to 7 years?

The answers you give will reveal if you are ready for this avenue of financing.

Crowdfunding

There are plenty of crowdfunding platforms to choose from, with Kickstarter and Indiegogo being a couple of the biggest names.

These platforms allow you to raise funds from supporters in exchange for perks such as early access, products or rewards. This mutually beneficial setup can be highly effective, especially if your business sells an in-demand product.

For crowdfunding to work, you need a strong brand and fan base. Of course, it helps significantly if your products have gone viral once or twice, so your marketing must be on-point.

The downside is that there is no guarantee of success, and planning campaigns is often time-consuming and expensive.

Alternative Financing

We’ve covered the main types of funding for small business growth, but there are still a few more options worth considering:

- Revenue-based financing: You receive an upfront investment and repay a percentage of future revenue until the agreed repayment amount is reached.

- Invoice factoring: You sell your outstanding invoices to a third-party factoring company in exchange for cash. The amount you receive is around 70% to 90% of the invoice’s value, and the third party pockets the rest.

- Merchant cash advances: You get a lump sum of short-term financing which is repaid via a percentage of the business’s future credit or debit card-based sales, plus fees.

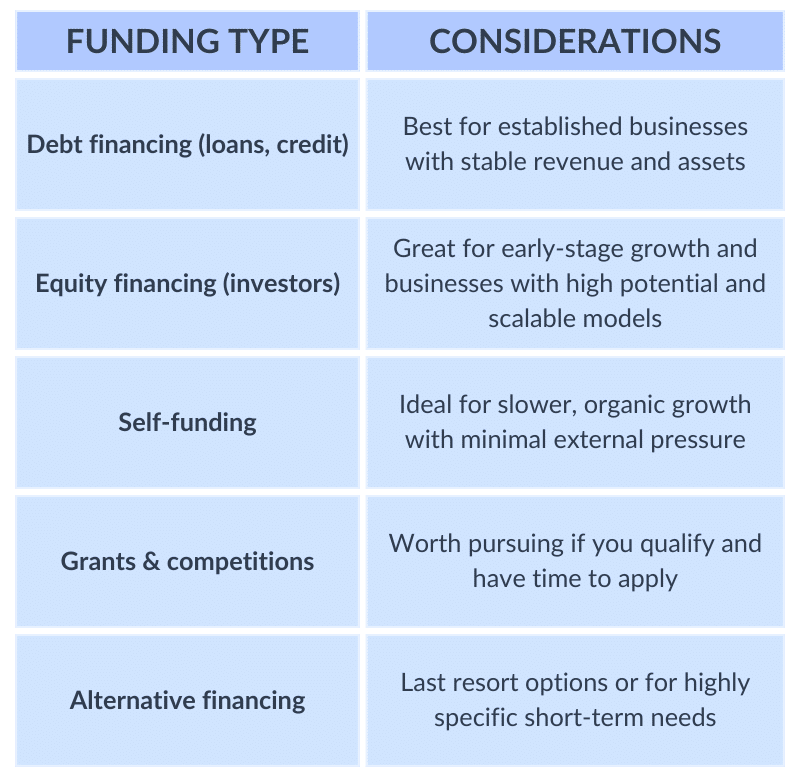

Framework for Choosing the Right Option for You

With so many options on the table for unlocking small business funds, where do you start? How do you know which is going to be right for your company?

To help, try following this framework:

- Business stage: Consider exactly where your business is at. Early growth? Scaling fast? Stabilizing? Investor options are great for aggressive early growth, but more traditional funding is better for later-stage growth.

- Urgency: Do you need money immediately, or can it wait a bit? Loans and investments have a lengthy process, while lines of credit unlock cash fast.

- Risk tolerance: Are you willing to give up a slice of ownership? Or do you prefer to maintain full control?

- Growth strategy: Is your growth steady and predictable, or aggressive and high-risk? Your funding approach should match your goals.

- Debt and equity: What trade-offs are you willing to make? Are you prepared to sacrifice equity or take on debt?

Tips for Getting Approved

When you apply for business funding, you need to be well-prepared to improve your chances of approval and avoid common pitfalls.

- Keep organized. Make sure your financial records are in order and that your accounting is up to date. Your business must be able to demonstrate consistent revenue and profitability.

- Stay on top of payments. Avoid irregular deposits and overdraft fees. Pay your invoices promptly to show you’re reliable.

- Keep your business plan up to date. Have a solid business plan that details your growth strategy so lenders can see exactly how the funds will be applied.

- Work to improve your credit scores. Don’t focus only on your business score, either. Lenders and investors will want to scrutinize both.

- Compare all your options. Secured loans often see better approval rates if you are willing to use existing assets as collateral. Be aware, though, that this increases your risk if things don’t work out.

- Understand lender criteria. Research each funding source’s requirements, then align your application to demonstrate how you meet the criteria.

- Double-check all applications. Even tiny errors, omissions or mistakes can lead to rejection.

- Don’t make simultaneous funding applications. Doing so can hurt your credit score and make you look desperate to lenders. Take advantage of online eligibility checkers and calculators to see if options are viable before submitting a formal application.

Finally, always keep in mind that business funding for small business owners is a complicated process, especially when so many choices are on the table.

If you’re looking for a significant amount of funding to grow your business but don’t know where to start, consider hiring a financial expert to help you navigate everything.

They will get your paperwork and reports in order and help you make improvements to your existing financial strategies to increase profitability.

A financial expert will also help you with your applications, showing your business off in the best light to increase your chances of getting approved.

If partnering with a financial expert sounds reassuring, get in touch with Finvisor. Our dedicated and professional team is on hand to give you the financial assistance you need.

Whether it’s growing an existing business, improving financial strategies, or simply providing general accounting services, Finvisor is your partner in helping your business thrive.

Let's chat

Get on our calendar for a free introductory call.Request a Quote

We'll get back to you within a business day, usually sooner. Or you can schedule an introductory call and get on our calendar."*" indicates required fields