For many business owners, the word “audit” sparks fear. But it doesn’t have to.

A business audit is simply a routine part of running a company, and as long as your finances are in order, there’s nothing to worry about.

Audits are a chance to show your team, stakeholders and potential investors that you’re operating efficiently and transparently, putting your business in the position to reach for bigger opportunities in the future.

Here’s what you can do to get ahead of the process and ensure it runs smoothly.

What Is a Financial Audit?

Before you begin preparing for an audit, it’s important to understand what one actually is.

In a nutshell, a financial audit is an independent assessment of your business’s financial statements, records and processes. The aim is to confirm whether or not your statements present an accurate and fair view of your company’s financial position.

Audits fall into two main categories:

- External audits are conducted by independent certified public accountants (CPAs) or specialized auditing firms. These are formal and are often triggered by regulators, lenders and investors.

- Internal audits are carried out by an organization’s auditing team and focus on internal controls, compliance and process efficiency. If a company is very small and doesn’t have an internal auditor, an independent and objective employee is typically assigned to conduct it.

However, audits involve more than simply checking the books. They also serve to:

- Ensure the business is compliant with regulatory bodies, tax authorities and accounting and industry standards.

- Provide transparency and reassure lenders and investors that the company’s financial information is accurate.

- Build credibility with stakeholders.

- Drive improvements by identifying areas of risk and vulnerability.

What Triggers an Audit?

Audits aren’t necessarily triggered because you’ve done something wrong, although that can certainly be a reason.

Public companies are required to undergo annual external audits as part of their reporting requirements.

Also, some highly regulated industries, like healthcare and finance, must conduct regular compliance audits to meet industry standards.

If you’re seeking investment or funding, then an audit may be requested as part of the decision-making process.

And finally, tax authorities like the IRS may initiate an audit if they detect discrepancies or red flags in your filings.

Why Preparing Your Books Matters

Audit preparation begins with getting your books in order, a standard practice every business should prioritize anyway for the sake of long-term financial health.

First, accurate, up-to-date books help you avoid costly mistakes and penalties. Without them, it’s easy to overestimate your available cash flow or overlook key expenses.

Second, it saves you a lot of stress and time. Rather than scrambling at the last minute to update records and find missing receipts, you’ll already have everything in place when the audit begins.

Third, keeping books audit-ready demonstrates that you are a reliable and responsible business owner. When you look good in this respect, you are more likely to secure favorable terms when seeking investment or funding.

Steps to Prepare Your Books for an Audit

So, how can your business prepare for an audit without getting overwhelmed? Follow these steps.

1. Organize Your Financial Records

Auditors need to see a clear trail of how your transactions have been recorded, categorized and supported.

This means all your records must be up to date and properly organized, including:

- General ledger: All transactions accurately recorded.

- Trial balance: A summary of all accounts and their balances.

- Bank statements: All monthly statements reconciled with your records.

- Receipts and invoices: Filed in chronological order and traceable to the corresponding transaction.

- Payroll records: Including salaries, benefits and tax withholdings.

2. Reconcile All Accounts

Preparing for an audit also means your books have to match external records, such as bank and credit card statements. Any discrepancies, even tiny ones, should be resolved before the audit takes place.

There are several types of reconciliations to perform:

- Bank reconciliations: Compare bank statements to your general ledger and confirm that deposits, withdrawals and balances align.

- Credit card reconciliations: Match any charges and payments against your records.

- Loan reconciliations: Outstanding balances, including interest and principal amounts, should match lender statements.

- Intercompany accounts: If your business has multiple entities, each entity’s transfers and balances must match across the books.

The next job is to match your accounts payable with accounts receivable. This assures the auditors that your reported liabilities and receivables are accurate.

For accounts receivable:

- Verify that all customer invoices are recorded.

- Confirm customer balances by sending out accounts receivable confirmations.

- Review overdue invoices and document collections.

For accounts payable:

- Ensure vendor invoices match purchase orders and payment records.

- Include any unpaid bills in your liabilities.

- Stay vigilant for duplicate payments or missed credits.

3. Review Internal Controls

Your internal controls are the systems you put in place to manage risk and prevent fraud and errors. If they are weak, it can place doubt on the reliability of your financial statements.

Key internal controls include:

- Separation of duties: No single employee should have full control over the entire transaction process.

- Approval processes: All purchases, payroll changes and expense reimbursements should go through an established approval procedure.

- Regular reviews and fraud checks: Focused on unusual transactions, vendor lists and round-dollar payments.

- Access controls: Set for financial systems based on job roles and needs.

All internal controls must be clearly documented to demonstrate how they are implemented and enforced. Be prepared, as auditors may test them out.

4. Ensure Compliance

When preparing for audits, compliance should take center stage. It’s non-negotiable, as failure to comply with regulations and accounting standards can result in penalties.

Therefore:

- All your financial and accounting processes and reports must align with Generally Accepted Accounting Principles (GAAP).

- If your organization operates internationally, it must also abide by International Financial Reporting Standards (IFRS).

- Make sure your tax records and filings are compliant, including sales tax, VAT, corporate income tax and payroll tax.

- Be aware of any industry-specific compliance rules. For example, DCAA compliance for government contractors includes strict rules on time tracking and labor cost reporting.

5. Prepare Supporting Documentation

Financial transactions don’t exist in isolation. The preparation of audit documents includes supporting information that verifies your contractual obligations and commitments.

Such documents include:

- Contracts

- Leases

- Insurance policies

- Board minutes

This list is by no means exhaustive. There are likely documents specific to your business operations that you may need to provide.

6. Work With Your Accountant

Audits can be overwhelming, especially if you’ve never gone through one before. That’s why your accountant will be your best ally throughout the process. If you don’t have one on staff, you can hire one through an outsourced provider like Finvisor.

An accountant will know how to audit books and will be a fantastic resource for conducting a pre-audit review to identify and address any issues before the real deal takes place.

Additionally, they can create an audit request list of all the documents you are likely to need, ensuring you’re well prepared in advance.

It’s important to have them by your side during the audit process as well, since they can answer the more technical questions on your behalf. Moreover, if there are discrepancies or confusion around accounting standards and regulations, they can provide their professional advice.

In short, they’ll ensure you don’t have to navigate the process alone and help you pass the audit smoothly.

Common Mistakes to Avoid During Audit Preparations

Don’t Procrastinate

One of the most common mistakes business owners make is leaving things to the last minute. They end up preparing audit documents in a rush, with no time to check for accuracy or errors.

Don’t do this. Auditors usually provide plenty of notice, so take advantage of the time you have to get ready.

Even better, keeping your books up to date as part of day-to-day financial management is best practice and will significantly cut down audit preparation time.

Don’t Lose Your Receipts

Another frequent mistake is missing receipts. All purchases, no matter how small, must be properly documented.

It’s a good idea to upload electronic versions in case originals are lost. For example, snapping a photo of the receipt as soon as you get it provides a permanent electronic record.

Don’t ignore small discrepancies, either! If you find one, you need to rectify it, even if it’s just one dollar.

Minor issues can suggest to auditors that there are larger issues at play. So, if you want to avoid extra questions and scrutiny, address all discrepancies before the audit begins.

Don’t Rely on Your Memory

Finally, your memory isn’t a reliable source of information. At least, not to auditors.

Verbal explanations don’t replace proper documentation. Always back all of your claims with written proof and receipts.

Tips for a Smoother Audit Experience

Want an easy audit experience? These financial audit preparation tips will help.

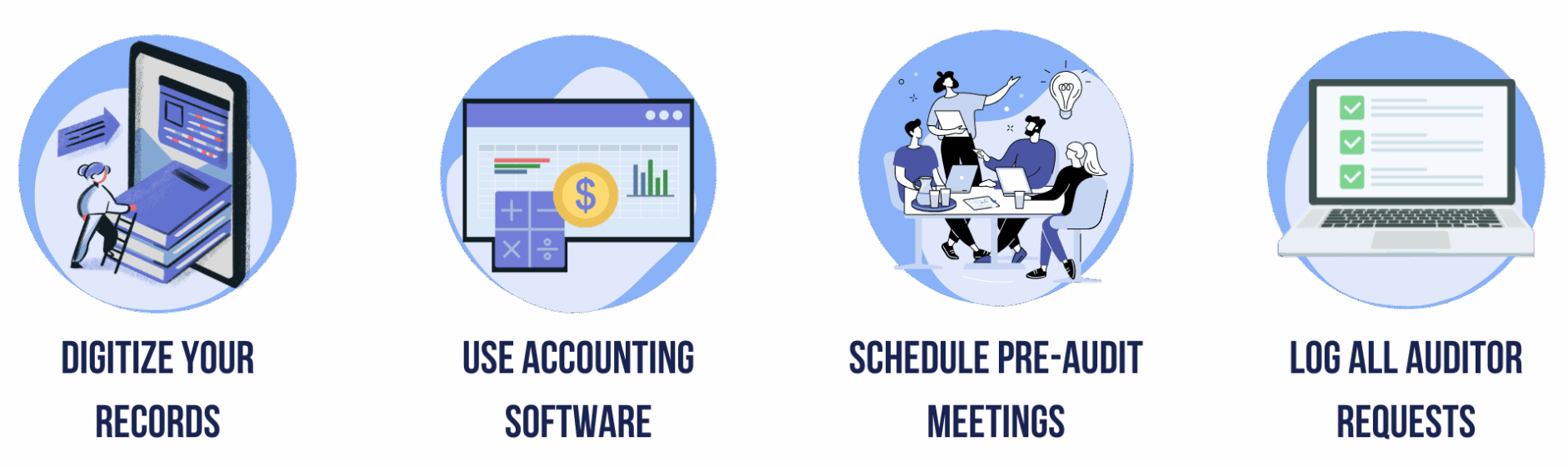

Digitize Your Records

Paper records are notoriously unreliable. They go missing, are difficult to keep organized and are, frankly, an outdated way to keep documentation.

Moreover, auditors now expect and prefer digital access to information.

Therefore, scan everything: receipts, invoices, contracts and any other records you may have. Store them in a secure location, such as a cloud-based accounting software. Label each file in a consistent manner, so you can quickly locate the right one when requested.

Use Accounting Software

Using the right tools will help you in so many ways. Proper accounting software takes the manual effort out of many of the processes outlined above, and will even automate much of it.

Modern platforms like QuickBooks or Xero can produce audit-ready reports at the click of a button and come equipped with most of the required internal controls.

Plus, accounting software is designed around GAAP and IFRS standards and will automatically flag discrepancies, so you’ll know immediately if there is something that must be dealt with.

While it does come at an additional cost to the business, the convenience and time accounting software saves during audits and day-to-day financial management usually far outweigh that cost.

Schedule Pre-Audit Meetings

Pre-audit meetings with your CPA allow you to scrutinize records and your internal controls before the auditors access them.

During these meetings, your CPA will simulate the auditor’s perspective, go through everything and highlight areas where your records may be incomplete or inconsistent.

Just as importantly, they give you and your CPA the chance to anticipate and answer the types of questions the auditor is likely to ask so you can prepare your responses in advance.

Log All Auditor Requests

During the audit, you will be asked for clarifications, supporting information and additional documents, even if your records are complete and well organized.

Keep a detailed log of all the auditor’s requests. Without logging these requests, it’s easy to forget something, which will delay the process unnecessarily.

You can designate a team member to maintain a running log or use a project management tool for the job. Even a spreadsheet can work in this case.

The key is to record each request and update its progress, including marking it off when it’s complete.

Final Thoughts

While you probably won’t ever enjoy an audit, proper preparation will make the process manageable. In fact, it can pay off by revealing opportunities to strengthen internal controls and enhance your financial recordkeeping.

Remember, the idea is not to catch you out; it’s to ensure your business maintains financial integrity and compliance, the very foundations of growth.

And if the process still feels daunting, remember that guidance and support are always available.

Finvisor provides outsourced CPA services to startups and small to medium-sized businesses. Specializing in a wide number of industries, our qualified professionals can help you with all aspects of financial management, not just audit preparation.

With pricing tailored to all budgets and business phases, you can get the support you need and at the right scale.

To find out how Finvisor can help you with audit readiness and more, we invite you to get in touch today.

Let's chat

Get on our calendar for a free introductory call.Request a Quote

We'll get back to you within a business day, usually sooner. Or you can schedule an introductory call and get on our calendar."*" indicates required fields