With cyberattacks and financial fraud on the rise, small businesses are just as vulnerable as large, international corporations.

In fact, 46% of all businesses with fewer than 1,000 employees have been affected by online security breaches.

Dealing with fraud is a costly headache for any business, putting sensitive information on the line, such as:

- Credit card numbers

- Bank account information

- Transaction history

- Customers’ information

- Loans

- Usernames and passwords

- PINs

- Social Security numbers

If these details are compromised, your company may suffer serious financial losses. Your reputation could also be negatively affected, making customers less likely to continue doing business with you.

Let’s learn more about the steps you can take now to keep your business financial information secure, so you don’t have to deal with costly problems later.

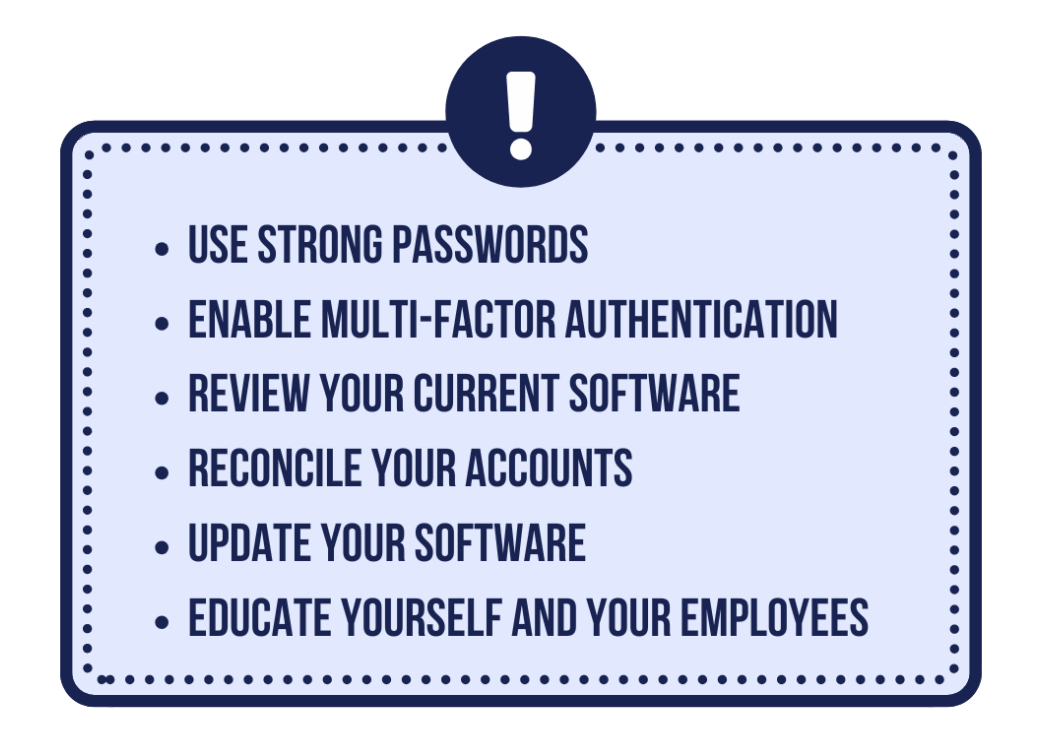

Steps to Secure Your Business Financial Data

Use Strong Passwords

Around half of all data breaches are caused by compromised credentials. The easiest first step to start locking down your company’s financial information is to create strong passwords.

Passwords should:

- Be unique. Don’t use the same password for any of your accounts.

- Be original. “Password123” is not secure. Use long passwords that contain a mixture of letters, numbers and symbols.

- Be impersonal. Don’t use easy-to-guess words like names of family members, pets or favorite teams. Also, avoid using numbers related to birthdays, anniversaries or any other data that can be easily found.

- Be changed regularly. Every few months is ideal.

Even if you’re aware of these tips, the reality is that no one likes remembering dozens of complicated passwords. That’s why it’s so tempting to reuse easy passwords.

Make it easier for your team by using password manager software. This makes it simple to log into all your accounts securely. You won’t have to remember complicated passwords, and the software can even generate unique ones for you.

Enable Multi-Factor Authentication

Multi-factor authentication (MFA) provides an extra layer of protection by requiring an additional step beyond simply entering a username and password.

Most commonly, a one-time password is sent to the account owner’s email or phone. Other MFA methods include using biometric data like fingerprints or facial recognition, or confirming your identity through another device.

Some websites also use adaptive authentication methods to determine if a login seems out of the ordinary. For instance, a login from a new location on an unrecognized device might prompt the user to provide more information to identify their identity. Suspicious login attempts may be blocked entirely.

Whenever possible, enable MFA, especially for any account that contains personal or financial data.

Review Your Current Software

All financial transactions should run through secure, trusted systems. Regular software reviews are essential for maintaining financial data security and avoiding cybersecurity incidents caused by outdated or unprotected tools.

Consider every accounting platform, invoicing tool, POS system and banking app your team works with. Ask yourself questions like:

- When was this software last updated?

- Does it receive frequent security patches?

- Does it use encryption for sensitive data?

- Does it offer advanced fraud monitoring services?

- Has the company had any data breaches in the past?

If the software isn’t a good fit for your company, don’t be afraid to switch to a different, more secure platform. Your customers and vendors should be able to trust that their information will be kept safe with every transaction.

Reconcile Your Accounts

Automation tools provided on financial software like QuickBooks can make billing and taxes a lot simpler for you, but they can’t always identify discrepancies or fraud.

Review all your accounts and statements at least once a week. Check to make sure that all transactions are valid, and rectify errors as soon as possible.

It’s also a good idea to check your business credit report once a month and investigate the source of any changes. Sudden dips in credit could indicate identity theft, fraud, credit inquiries or unauthorized loans taken out in your name.

Update Your Software

At some point, most people have clicked the “remind me later” button when it’s time to update their software. But even though it’s tempting to postpone updates, many hackers exploit vulnerabilities in outdated software to access financial data.

New updates should be installed as soon as possible. They often include important patches that make your software more secure and stable.

Encourage your whole team to regularly update all software, or even better, enable automatic updates. This reduces the risk of exposing your company’s financial information through known security flaws.

Educate Yourself and Your Employees

Your team plays a significant role in helping keep your financial data secure and private. All it takes is one employee clicking on a fake link in a phishing email to lead to hours of extra work and thousands of dollars in losses.

Educate everyone on cybersecurity, phishing strategies, malware and other potential threats. An hour or two of training every year can go a long way toward preventing a data breach.

Put actionable policies in place to help employees keep their credentials and accounts as secure as possible.

As a business owner, you’re not immune to security breaches either. New AI-driven phishing scams are more convincing than ever, and are able to target specific individuals like never before. Stay updated on new security threats by reading industry publications.

Staying educated may be the difference between avoiding a breach and suffering a costly incident that puts your sensitive financial data in the wrong hands.

Final Thoughts

Strong financial security protects your assets and helps build trust with customers, partners and employees, while also keeping your business running smoothly.

Even steps as simple as changing your password or scheduling time to look over transactions every Friday can make a huge difference.

Ready to take your financial oversight to the next level? Partner with Finvisor and gain the guidance you need to secure your finances.

Our fractional CFO services and financial advisors are here to give you the support you need to put secure, scalable systems in place. Contact us today to learn more.

Let's chat

Get on our calendar for a free introductory call.Request a Quote

We'll get back to you within a business day, usually sooner. Or you can schedule an introductory call and get on our calendar."*" indicates required fields