Choosing the right accounting software can make a huge difference for your business, saving you time and providing valuable insights into your company’s financial health.

QuickBooks Online and Xero are two of the top accounting software options available today for small business bookkeeping and financial management. But which one is the right fit for your operations?

To help you choose, let’s compare them side by side and explore the features each software offers.

Similarities Between QuickBooks and Xero

Before diving into the differences between QuickBooks and Xero, let’s start by exploring what the two platforms have in common.

Wide Range of Comprehensive Accounting Tools

Both of these platforms are top choices for small business accounting software, and for good reason. Each offers a wide range of comprehensive accounting tools designed to automate bookkeeping and streamline financial tasks.

QuickBooks and Xero both allow you to manage your incoming and outgoing payments, track bills, manage taxes and oversee other key aspects of your business’s finances.

Ability to Connect With Other Financial Tools

Seamless connection with your financial institution is a non-negotiable feature for modern accounting software.

Luckily, both QuickBooks and Xero make it easy to connect with thousands of banks globally, allowing you to automate your data and get up-to-date cash flow information.

Moreover, both platforms integrate easily with hundreds of other business tools like payroll software and payment processing applications that you may already be using.

User-Friendly Mobile Apps

If you’re like most business owners, you’re frequently on the go and don’t always have time to sit down at a computer. Fortunately, both QuickBooks and Xero offer easy-to-use mobile apps, allowing you to access your finances from wherever you are.

Both apps make it easy to send and view invoices, track payments, scan receipts, monitor cash flow and more.

Seamless Scalability

QuickBooks and Xero offer multiple plans, allowing you to seamlessly scale your service up or down depending on your business needs. Both platforms are ideal for growing small businesses.

QuickBooks

QuickBooks has been around since 1992. Originally a desktop-based solution, it has evolved into a cloud-based software platform that makes it simple for business owners to access their financial data on the go.

Plans

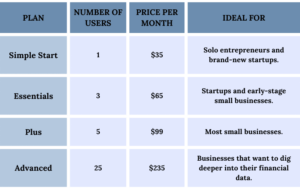

As of 2025, QuickBooks Online offers four plans.

Every plan includes access to invoicing, payments, receipt capture, bill management, cash flow tracking and other automated bookkeeping features.

- Simple Start – Ideal for solo entrepreneurs and brand-new startups. This plan includes limited bank transfers and the ability to connect one sales channel.

- Essentials – Ideal for startups and early-stage small businesses. This plan adds on recurring invoices, the ability to use multiple currencies and other transaction automation features.

- Plus – Ideal for most small businesses. This plan adds on budgeting tools, profit and loss insights, anomaly detection and integration with all your sales channels.

- Advanced – Ideal for businesses that want to dig deeper into their financial data. This plan adds on a host of features, including forecasting, report building, project management tools and KPI analysis.

Number of Users

The number of users who can access a given QuickBooks account is based on the plan that you choose. While this can help protect sensitive data, the lowest plans may feel restrictive if you want to collaborate with team members.

- Simple Start – One user

- Essentials – Three users

- Plus – Five users

- Advanced – Twenty-five users

Pricing

QuickBooks is one of the pricier options on the market. However, it frequently runs deals for new users, helping you save hundreds of dollars on your first few months of using the software.

As of 2025, prices start at:

- Simple Start – $35 per month

- Essentials – $65 per month

- Plus – $99 per month

- Advanced – $235 per month

Who is QuickBooks Best For?

QuickBooks is best for small businesses that want easy-to-use software with tons of features. It’s also a great choice if you’re looking for a highly customizable experience.

Moreover, QuickBooks offers more in-depth financial reporting and automation tools, especially in its Advanced plan.

Xero

Xero has only been around since 2006, but it’s quickly cemented itself as one of the best financial management software options for startups and small businesses.

Tailored to the needs of growing startups and small to medium-sized businesses, Xero prioritizes offering its users a simple-to-use, collaborative experience.

Plans

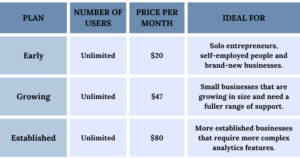

As of 2025, Xero offers three plans.

All plans offer convenient connection to your bank, accounting reports, inventory management, customer payment acceptance, purchase order software, file storage and automatic sales tax capabilities.

- Early – Ideal for solo entrepreneurs, self-employed people and brand-new businesses. You’ll be able to send up to 20 online invoices and quotes, schedule up to 5 bills, reconcile bank transactions and gain basic cash flow insights.

- Growing – Ideal for small businesses that are growing in size and need a fuller range of support. You’ll be able to send an unlimited number of online invoices and quotes and pay all your scheduled bills.

- Established – Ideal for more established businesses that require more complex analytics features. You’ll be able to use multiple currencies, track projects, manage your expenses and plan up to 90 days ahead with Xero’s advanced analytics tools.

Number of Users

Xero does not limit the number of users that can access your plan. All plans allow unlimited access to your account, making it convenient for collaborating with your whole team.

Price

Xero’s pricing is typically lower than QuickBooks, with its early plan being especially affordable (though its features are quite limited for most businesses).

As with QuickBooks, Xero frequently offers great discounts on your first few months of using their service, potentially helping you save hundreds of dollars upfront.

As of 2025, Xero’s plans start at:

- Early – $20 per month.

- Growing- $47 per month.

- Established – $80 per month.

Who is Xero Best For?

Xero is best for small and medium businesses that need an easy-to-use set of accounting and inventory management tools with unlimited user access. Its scalability also makes it an appealing option for growing startups.

Which Accounting Software is Best for My Company?

Choosing the right accounting software is essential for streamlining your operations and freeing up valuable time to focus on running and growing your business.

Need help choosing between QuickBooks and Xero? Want to get deeper insights into your business finances?

Even the most advanced accounting software works best when it’s paired with real, live financial experts, like our team at Finvisor.

Reach out and schedule a free introductory call to see how we can help your business reach all of its goals.

Let's chat

Get on our calendar for a free introductory call.Request a Quote

We'll get back to you within a business day, usually sooner. Or you can schedule an introductory call and get on our calendar."*" indicates required fields